EX-99.2

Published on August 9, 2024

|

SECOND QUARTER 2024 |

|

2 FORWARD-LOOKING STATEMENTS Please note that in this presentation we may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,” “intends,” “future,” and similar expressions which constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on our expectations and beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in this presentation, include, but are not limited to, potential legal, reputational, operational and financial effects on the Company resulting from the cybersecurity incident that the Company reported in July 2024 and/or future cybersecurity incidents on the Company’s business, operations and financial results as well as the effectiveness of the Company’s response and mitigation efforts to any such cybersecurity incidents, as well as those risks and uncertainties more fully described from time to time in the Company's public reports filed with the Securities and Exchange Commission, including under the section titled “Risk Factors” in the Company's Annual Report on Form 10-K, and/or Quarterly Reports on Form 10-Q, as well as in the Company’s Current Reports on Form 8-K. All forward-looking statements included in this presentation are based upon information available to the Company as of the date of this presentation and speak only as of the date hereof. We assume no obligation to update any forward- looking statements to reflect events or circumstances after the date of this presentation. 2 |

|

TODAY’S PRESENTERS 4 BRAD WILLIAMS President BLAINE BROWERS Chief Financial Officer WARREN KANDERS Chief Executive Officer and Chairman of the Board |

|

4 AGENDA • Q2 Highlights • Business Overview • Financial Summary • Full Year Outlook • Conclusion and Q&A |

|

5 CONTINUED EXECUTION IN Q2 Cadre continues to deliver on strategic objectives, generating significant quarterly Adj. EBITDA growth and strong margins Pricing Growth: ✓ Exceeded target Q2 Mix: − Neutral mix in the quarter, positive portfolio mix offset by product mix Orders Backlog: − As expected, EOD and duty gear backlog lower as large shipments were delivered Healthy M&A Funnel: ✓ Continue to actively evaluate pipeline of opportunities Returned Capital to Shareholders: ✓ Declared eleventh consecutive quarterly dividend Commentary: |

|

6 LONG-TERM INDUSTRY TAILWINDS SUPPORTING SUSTAINABLE GROWTH OPPORTUNITY Public Safety Tailwinds Nuclear Safety Tailwinds Environmental Safety: Growing DoE environmental liability across multiple sites requiring remediation spend spanning 60+ years National Security: Expanding national defense programs drive consistent and growing demand Nuclear Energy: Increasing global demand for sustainable and clean energy driving investment in nuclear energy, including next gen reactors European leaders continue to advocate for significant increases in defense budgets Police protection expenditures have continued to trend upward even during previous financial and industrial recessions Major US cities continue to increase police budgets |

|

7 • Police protection expenditures remain stable as recruiting to fill open positions continues • Demand for EOD products after global conflicts de-escalate will lead to future opportunities • While demand for Cadre’s products was strong in Q2, macro consumer weakness remains a concern for businesses serving this segment • Successful new product launches across many of our categories continue to generate positive feedback from customers North American Law Enforcement Geopolitical Landscape Consumer New Products/ Innovation LATEST MARKET TRENDS |

|

8 KEY M&A CRITERIA Business Financial Market Leading market position Cost structure where material > labor High cost of substitution Leading and defensible technology Mission -critical to customer Strong brand recognition Recurring revenue profile Asset -light Attractive ROIC Niche market No large -cap competition Resiliency through market cycles |

|

9 Q2 Financial Results |

|

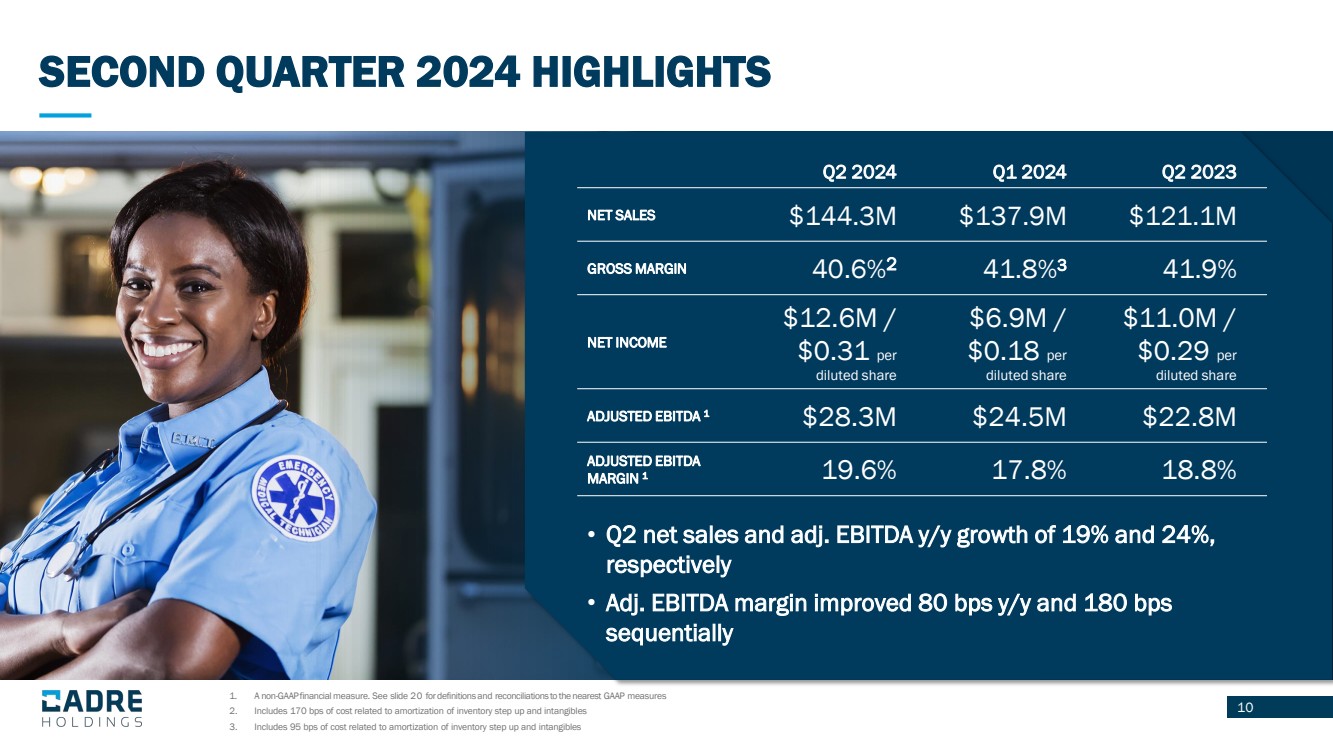

10 1. A non-GAAP financial measure. See slide 20 for definitions and reconciliations to the nearest GAAP measures 2. Includes 170 bps of cost related to amortization of inventory step up and intangibles 3. Includes 95 bps of cost related to amortization of inventory step up and intangibles • Q2 net sales and adj. EBITDA y/y growth of 19% and 24%, respectively • Adj. EBITDA margin improved 80 bps y/y and 180 bps sequentially SECOND QUARTER 2024 HIGHLIGHTS Q2 2024 Q1 2024 Q2 2023 NET SALES $144.3M $137.9M $121.1M GROSS MARGIN 40.6%2 41.8%3 41.9% NET INCOME $12.6M / $0.31 per diluted share $6.9M / $0.18 per diluted share $11.0M / $0.29 per diluted share ADJUSTED EBITDA 1 $28.3M $24.5M $22.8M ADJUSTED EBITDA MARGIN 1 19.6% 17.8% 18.8% |

|

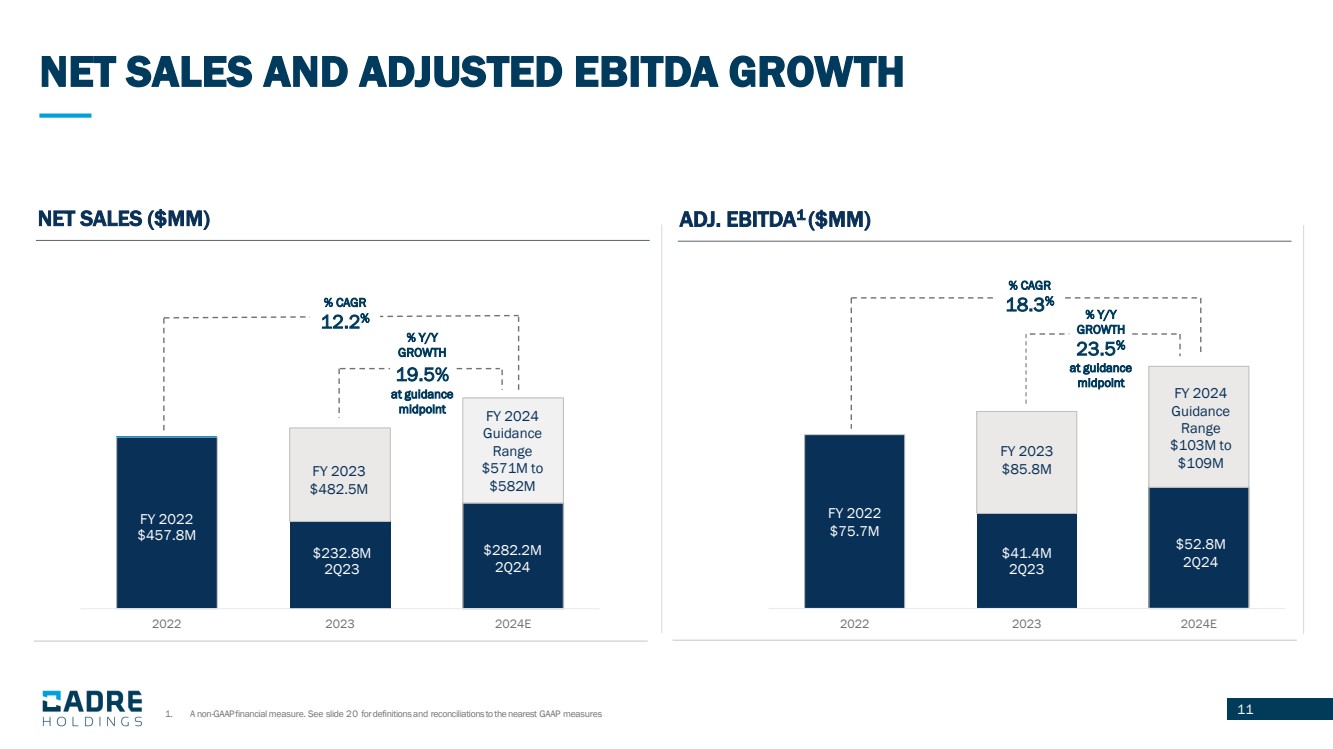

11 NET SALES AND ADJUSTED EBITDA GROWTH 1. A non-GAAP financial measure. See slide 20 for definitions and reconciliations to the nearest GAAP measures NET SALES ($MM) $0.0 $232.8M 2Q23 FY 2022 $457.8M 2022 2023 2024E FY 2023 $482.5M ADJ. EBITDA1 ($MM) $41.4M 2Q23 2022 2023 2024E FY 2024 Guidance Range $571M to $582M FY 2024 Guidance Range $103M to $109M % CAGR 12.2% % Y/Y GROWTH 19.5% at guidance midpoint % CAGR 18.3% % Y/Y GROWTH 23.5% at guidance midpoint $282.2M 2Q24 $52.8M 2Q24 FY 2022 $75.7M FY 2023 $85.8M |

|

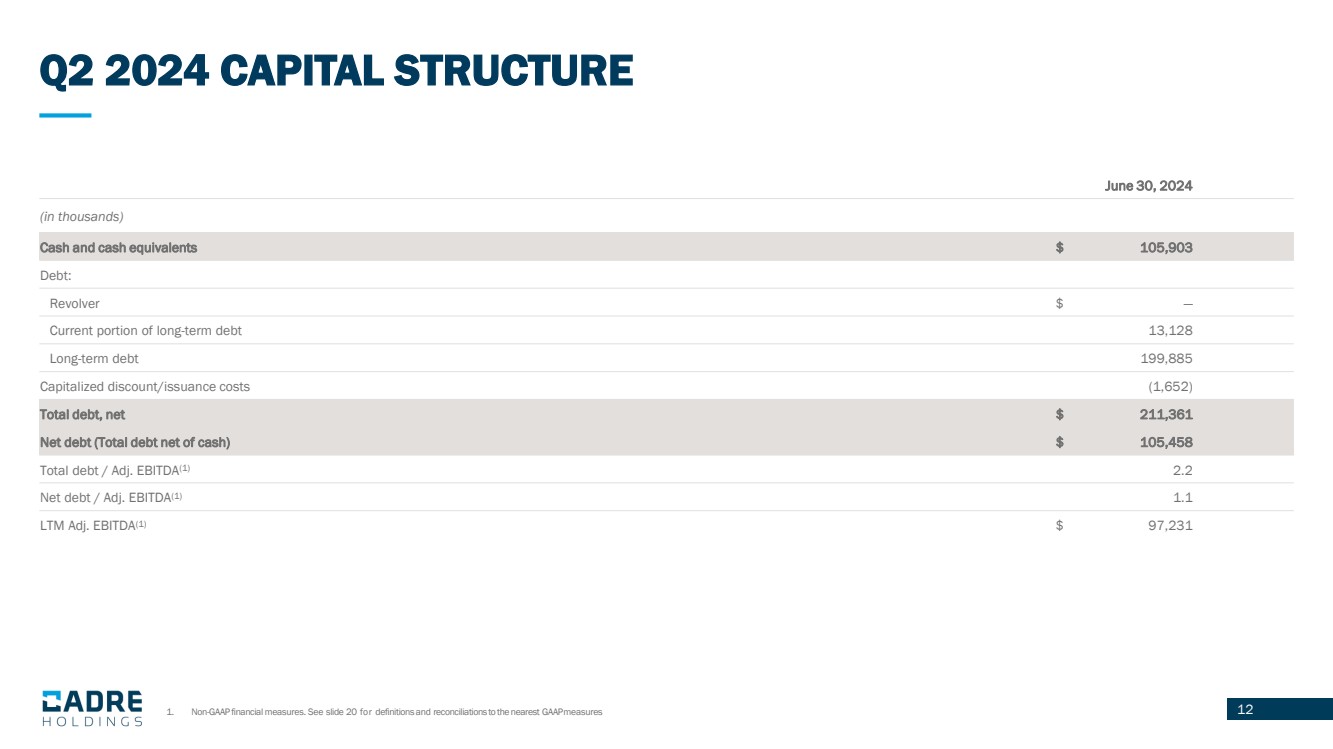

12 Q2 2024 CAPITAL STRUCTURE 1. Non-GAAP financial measures. See slide 20 for definitions and reconciliations to the nearest GAAPmeasures June 30, 2024 (in thousands) Cash and cash equivalents $ 105,903 Debt: Revolver $ — Current portion of long-term debt 13,128 Long-term debt 199,885 Capitalized discount/issuance costs (1,652) Total debt, net $ 211,361 Net debt (Total debt net of cash) $ 105,458 Total debt / Adj. EBITDA(1) 2.2 Net debt / Adj. EBITDA(1) 1.1 LTM Adj. EBITDA(1) $ 97,231 |

|

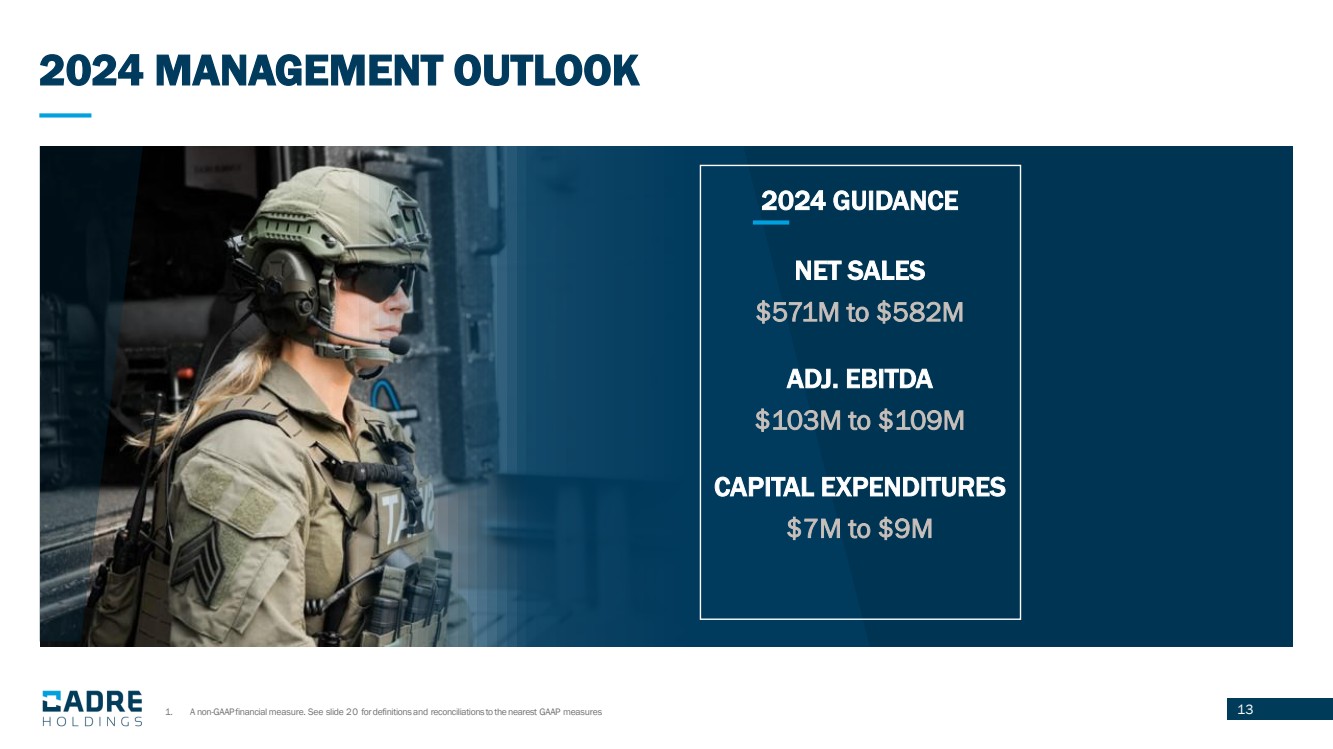

13 2024 MANAGEMENT OUTLOOK 2024 GUIDANCE NET SALES $571M to $582M ADJ. EBITDA $103M to $109M CAPITAL EXPENDITURES $7M to $9M 1. A non-GAAP financial measure. See slide 20 for definitions and reconciliations to the nearest GAAP measures |

|

CONCLUSION 14 Continued strong execution in Q2 Increased Quarterly Net Sales, Net Income, Adjusted EBITDA and Adjusted EBITDA Margin Ongoing implementation of Cadre operating model Committed to improving gross and Adj. EBITDA margins Capitalizing on strong macro tailwinds driving demand and visibility for Cadre's mission-critical products Continuously focused on M&A opportunities |

|

15 APPENDIX |

|

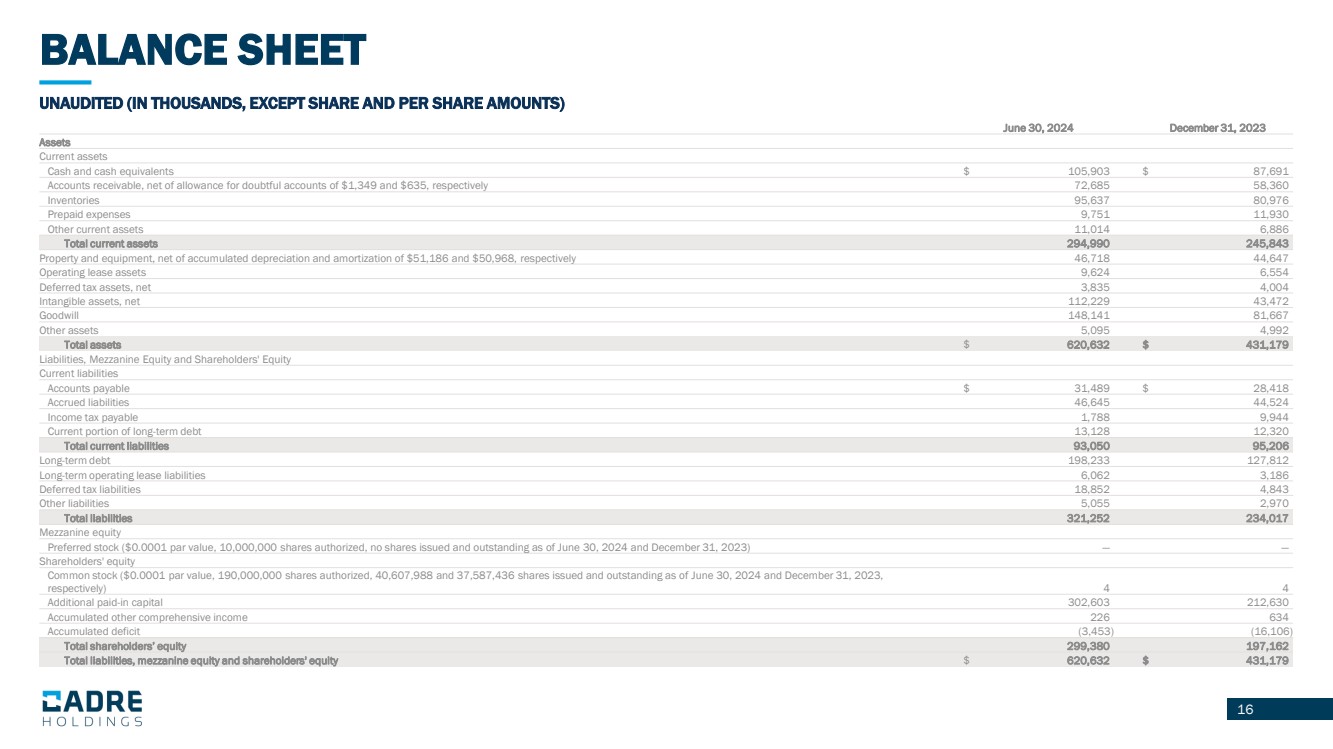

16 BALANCE SHEET UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) June 30, 2024 December 31, 2023 Assets Current assets Cash and cash equivalents $ 105,903 $ 87,691 Accounts receivable, net of allowance for doubtful accounts of $1,349 and $635, respectively 72,685 58,360 Inventories 95,637 80,976 Prepaid expenses 9,751 11,930 Other current assets 11,014 6,886 Total current assets 294,990 245,843 Property and equipment, net of accumulated depreciation and amortization of $51,186 and $50,968, respectively 46,718 44,647 Operating lease assets 9,624 6,554 Deferred tax assets, net 3,835 4,004 Intangible assets, net 112,229 43,472 Goodwill 148,141 81,667 Other assets 5,095 4,992 Total assets $ 620,632 $ 431,179 Liabilities, Mezzanine Equity and Shareholders' Equity Current liabilities Accounts payable $ 31,489 $ 28,418 Accrued liabilities 46,645 44,524 Income tax payable 1,788 9,944 Current portion of long-term debt 13,128 12,320 Total current liabilities 93,050 95,206 Long-term debt 198,233 127,812 Long-term operating lease liabilities 6,062 3,186 Deferred tax liabilities 18,852 4,843 Other liabilities 5,055 2,970 Total liabilities 321,252 234,017 Mezzanine equity Preferred stock ($0.0001 par value, 10,000,000 shares authorized, no shares issued and outstanding as of June 30, 2024 and December 31, 2023) — — Shareholders' equity Common stock ($0.0001 par value, 190,000,000 shares authorized, 40,607,988 and 37,587,436 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) 4 4 Additional paid-in capital 302,603 212,630 Accumulated other comprehensive income 226 634 Accumulated deficit (3,453) (16,106) Total shareholders’ equity 299,380 197,162 Total liabilities, mezzanine equity and shareholders' equity $ 620,632 $ 431,179 |

|

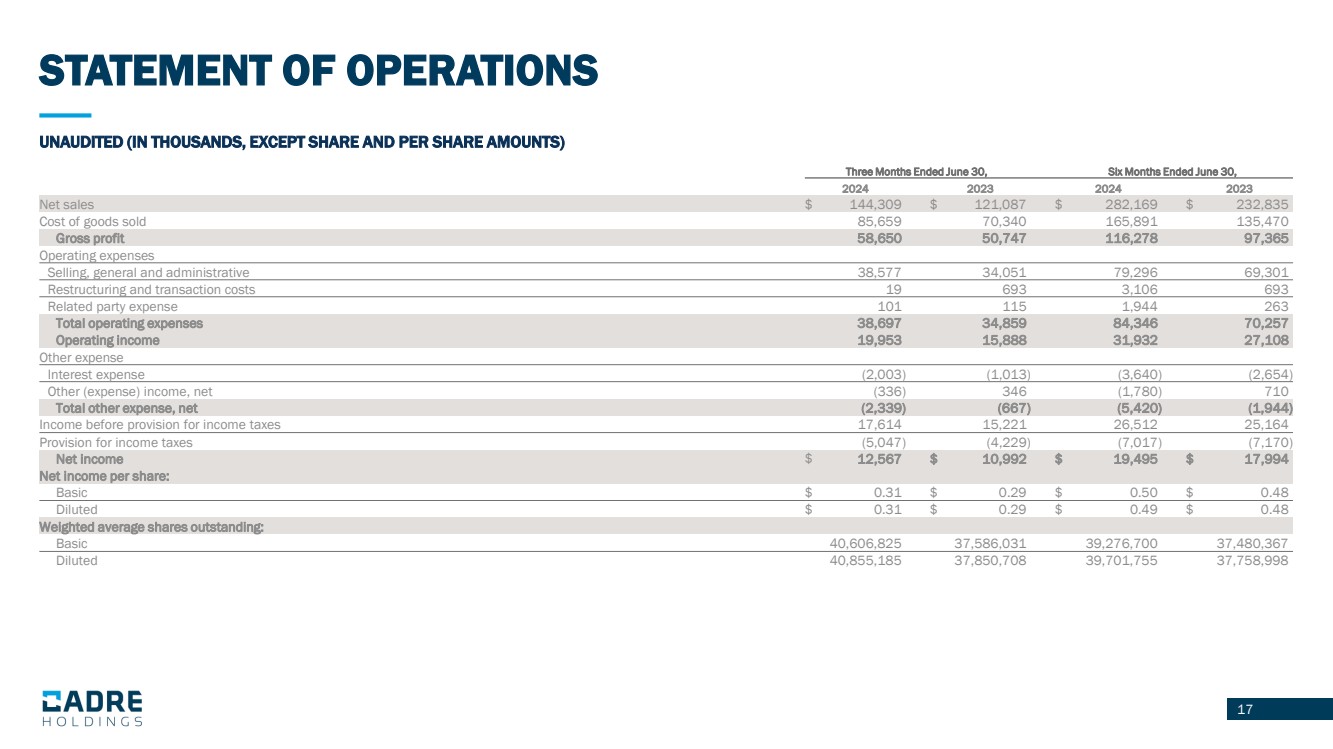

17 STATEMENT OF OPERATIONS UNAUDITED (IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net sales $ 144,309 $ 121,087 $ 282,169 $ 232,835 Cost of goods sold 85,659 70,340 165,891 135,470 Gross profit 58,650 50,747 116,278 97,365 Operating expenses Selling, general and administrative 38,577 34,051 79,296 69,301 Restructuring and transaction costs 19 693 3,106 693 Related party expense 101 115 1,944 263 Total operating expenses 38,697 34,859 84,346 70,257 Operating income 19,953 15,888 31,932 27,108 Other expense Interest expense (2,003) (1,013) (3,640) (2,654) Other (expense) income, net (336) 346 (1,780) 710 Total other expense, net (2,339) (667) (5,420) (1,944) Income before provision for income taxes 17,614 15,221 26,512 25,164 Provision for income taxes (5,047) (4,229) (7,017) (7,170) Net income $ 12,567 $ 10,992 $ 19,495 $ 17,994 Net income per share: Basic $ 0.31 $ 0.29 $ 0.50 $ 0.48 Diluted $ 0.31 $ 0.29 $ 0.49 $ 0.48 Weighted average shares outstanding: Basic 40,606,825 37,586,031 39,276,700 37,480,367 Diluted 40,855,185 37,850,708 39,701,755 37,758,998 |

|

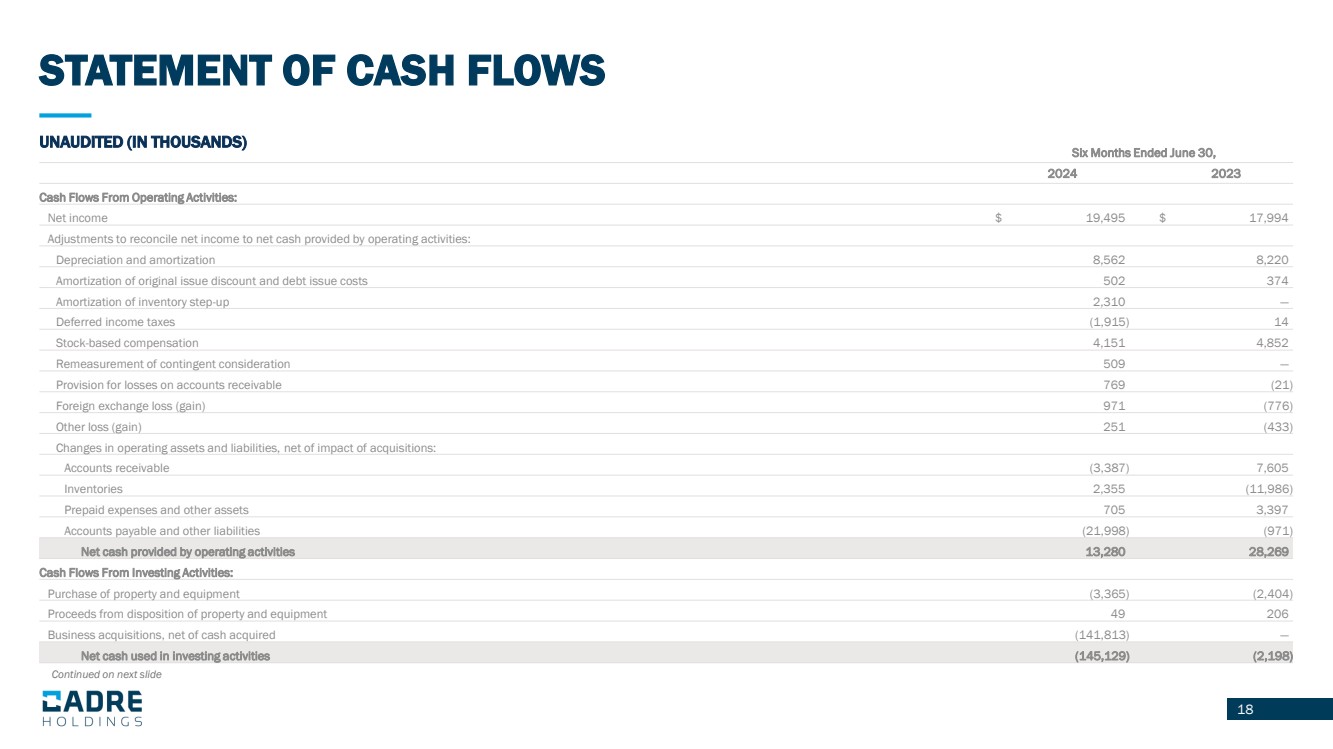

18 STATEMENT OF CASH FLOWS UNAUDITED (IN THOUSANDS) Six Months Ended June 30, 2024 2023 Cash Flows From Operating Activities: Net income $ 19,495 $ 17,994 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 8,562 8,220 Amortization of original issue discount and debt issue costs 502 374 Amortization of inventory step-up 2,310 — Deferred income taxes (1,915) 14 Stock-based compensation 4,151 4,852 Remeasurement of contingent consideration 509 — Provision for losses on accounts receivable 769 (21) Foreign exchange loss (gain) 971 (776) Other loss (gain) 251 (433) Changes in operating assets and liabilities, net of impact of acquisitions: Accounts receivable (3,387) 7,605 Inventories 2,355 (11,986) Prepaid expenses and other assets 705 3,397 Accounts payable and other liabilities (21,998) (971) Net cash provided by operating activities 13,280 28,269 Cash Flows From Investing Activities: Purchase of property and equipment (3,365) (2,404) Proceeds from disposition of property and equipment 49 206 Business acquisitions, net of cash acquired (141,813) — Net cash used in investing activities (145,129) (2,198) Continued on next slide |

|

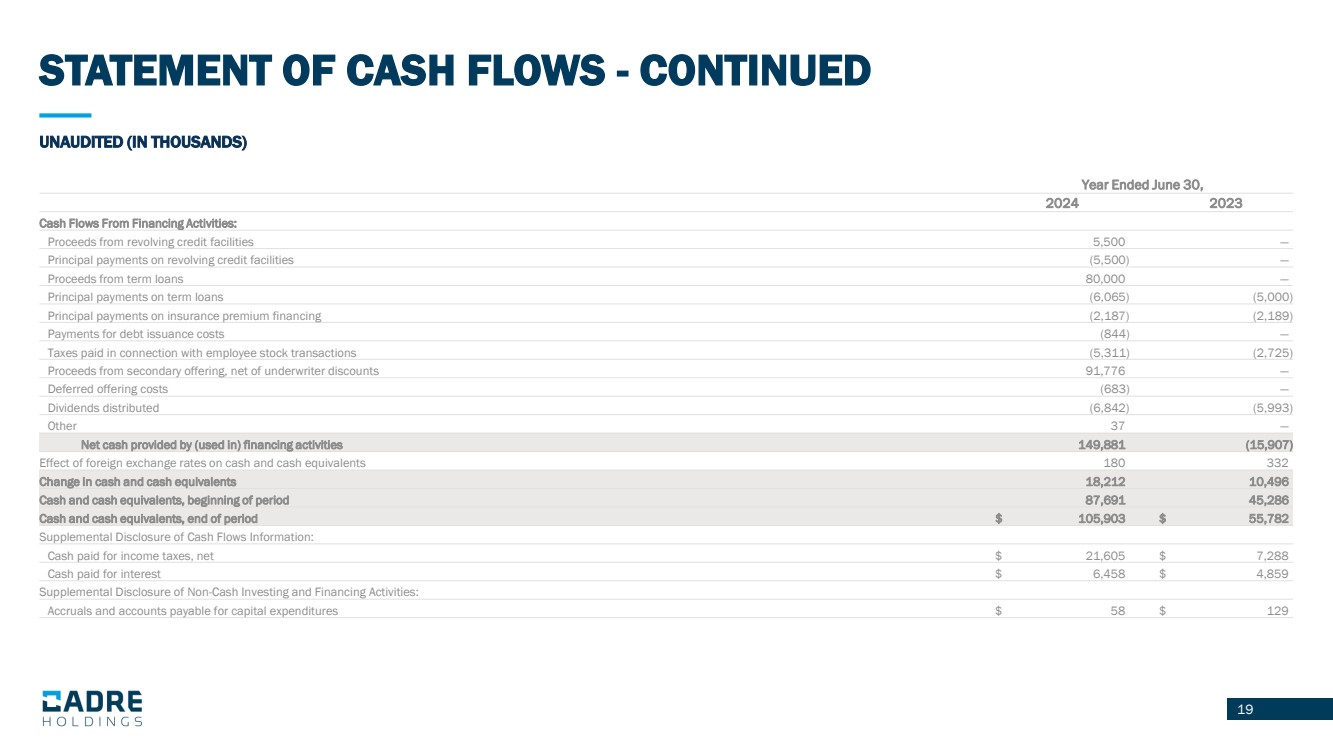

19 STATEMENT OF CASH FLOWS - CONTINUED UNAUDITED (IN THOUSANDS) Year Ended June 30, 2024 2023 Cash Flows From Financing Activities: Proceeds from revolving credit facilities 5,500 — Principal payments on revolving credit facilities (5,500) — Proceeds from term loans 80,000 — Principal payments on term loans (6,065) (5,000) Principal payments on insurance premium financing (2,187) (2,189) Payments for debt issuance costs (844) — Taxes paid in connection with employee stock transactions (5,311) (2,725) Proceeds from secondary offering, net of underwriter discounts 91,776 — Deferred offering costs (683) — Dividends distributed (6,842) (5,993) Other 37 — Net cash provided by (used in) financing activities 149,881 (15,907) Effect of foreign exchange rates on cash and cash equivalents 180 332 Change in cash and cash equivalents 18,212 10,496 Cash and cash equivalents, beginning of period 87,691 45,286 Cash and cash equivalents, end of period $ 105,903 $ 55,782 Supplemental Disclosure of Cash Flows Information: Cash paid for income taxes, net $ 21,605 $ 7,288 Cash paid for interest $ 6,458 $ 4,859 Supplemental Disclosure of Non-Cash Investing and Financing Activities: Accruals and accounts payable for capital expenditures $ 58 $ 129 |

|

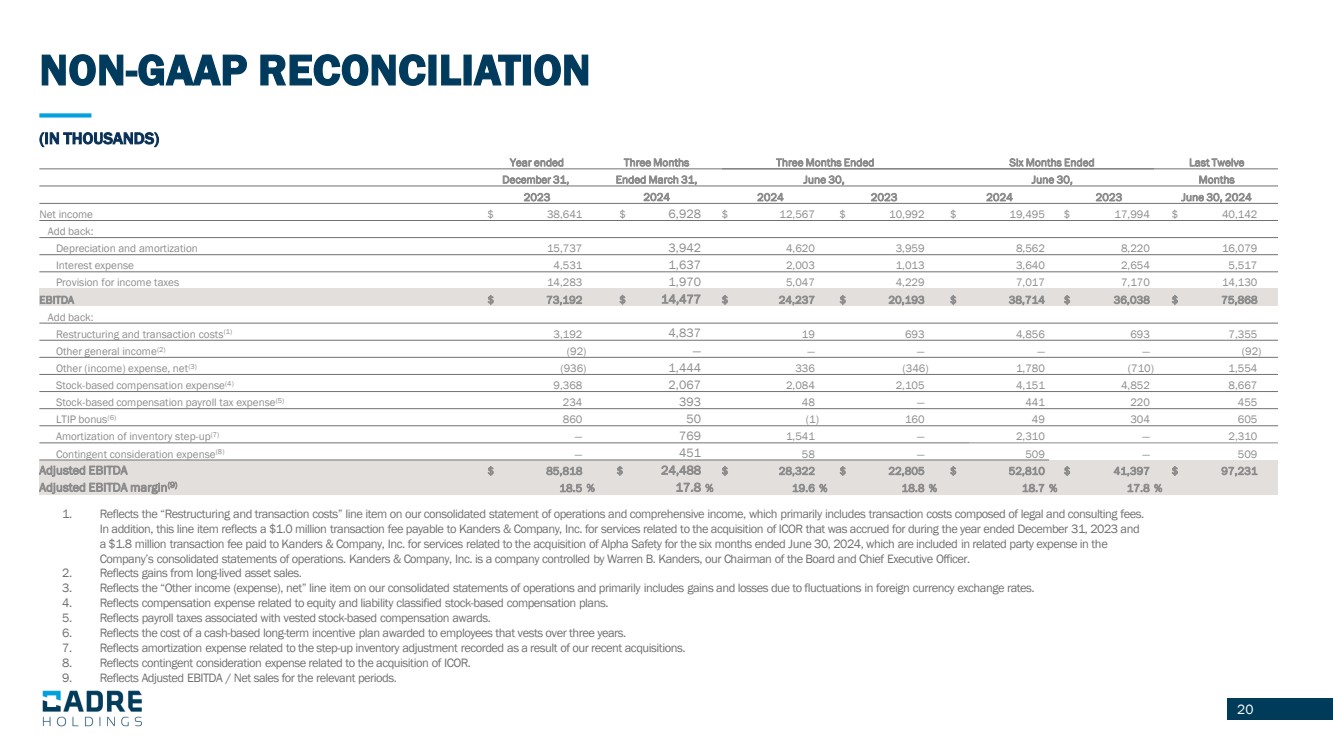

20 1. Reflects the “Restructuring and transaction costs” line item on our consolidated statement of operations and comprehensive income, which primarily includes transaction costs composed of legal and consulting fees. In addition, this line item reflects a $1.0 million transaction fee payable to Kanders & Company, Inc. for services related to the acquisition of ICOR that was accrued for during the year ended December 31, 2023 and a $1.8 million transaction fee paid to Kanders & Company, Inc. for services related to the acquisition of Alpha Safety for the six months ended June 30, 2024, which are included in related party expense in the Company’s consolidated statements of operations. Kanders & Company, Inc. is a company controlled by Warren B. Kanders, our Chairman of the Board and Chief Executive Officer. 2. Reflects gains from long-lived asset sales. 3. Reflects the “Other income (expense), net” line item on our consolidated statements of operations and primarily includes gains and losses due to fluctuations in foreign currency exchange rates. 4. Reflects compensation expense related to equity and liability classified stock-based compensation plans. 5. Reflects payroll taxes associated with vested stock-based compensation awards. 6. Reflects the cost of a cash-based long-term incentive plan awarded to employees that vests over three years. 7. Reflects amortization expense related to the step-up inventory adjustment recorded as a result of our recent acquisitions. 8. Reflects contingent consideration expense related to the acquisition of ICOR. 9. Reflects Adjusted EBITDA / Net sales for the relevant periods. 20 (IN THOUSANDS) NON-GAAP RECONCILIATION Year ended Three Months Three Months Ended Six Months Ended Last Twelve December 31, Ended March 31, June 30, June 30, Months 2023 2024 2024 2023 2024 2023 June 30, 2024 Net income $ 38,641 $ 6,928 $ 12,567 $ 10,992 $ 19,495 $ 17,994 $ 40,142 Add back: Depreciation and amortization 15,737 3,942 4,620 3,959 8,562 8,220 16,079 Interest expense 4,531 1,637 2,003 1,013 3,640 2,654 5,517 Provision for income taxes 14,283 1,970 5,047 4,229 7,017 7,170 14,130 EBITDA $ 73,192 $ 14,477 $ 24,237 $ 20,193 $ 38,714 $ 36,038 $ 75,868 Add back: Restructuring and transaction costs(1) 3,192 4,837 19 693 4,856 693 7,355 Other general income(2) (92) — — — — — (92) Other (income) expense, net(3) (936) 1,444 336 (346) 1,780 (710) 1,554 Stock-based compensation expense(4) 9,368 2,067 2,084 2,105 4,151 4,852 8,667 Stock-based compensation payroll tax expense(5) 234 393 48 — 441 220 455 LTIP bonus(6) 860 50 (1) 160 49 304 605 Amortization of inventory step-up(7) — 769 1,541 — 2,310 — 2,310 Contingent consideration expense(8) — 451 58 — 509 — 509 Adjusted EBITDA $ 85,818 $ 24,488 $ 28,322 $ 22,805 $ 52,810 $ 41,397 $ 97,231 Adjusted EBITDA margin(9) 18.5 % 17.8 % 19.6 % 18.8 % 18.7 % 17.8 % |

|

21 USE OF NON-GAAP MEASURES The Company reports its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). The presentation contains the non-GAAP measures: (i) earnings before interest, taxes, other income or expense, depreciation and amortization (“EBITDA”), (ii) adjusted EBITDA, (iii) adjusted EBITDA margin and (iv) last twelve months adjusted EBITDA. The Company believes the presentation of these non-GAAP measures provides useful information for the understanding of its ongoing operations and enables investors to focus on period- over-period operating performance, and thereby enhances the user’s overall understanding of the Company’s current financial performance relative to past performance and provides, along with the nearest GAAP measures, a baseline for modeling future earnings expectations. Non-GAAP measures are reconciled to comparable GAAP financial measures within this presentation. We do not provide a reconciliation of the non-GAAP guidance measure Adjusted EBITDA for the fiscal year 2024 to net income for the fiscal year 2024, the most comparable GAAP financial measure, due to the inherent difficulty of forecasting certain types of expenses and gains, without unreasonable effort, which affect net income but not Adjusted EBITDA. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Additionally, the Company notes that there can be no assurance that the above referenced non-GAAP financial measures are comparable to similarly titled financial measures used by other publicly traded companies. |